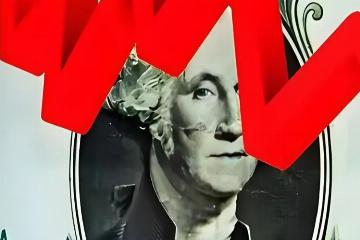

Nvidia Loses $240B in Market Value Overnight

Advertisements

On January 7, U.Sstock markets experienced a significant downturn, with major indices closing lowerThis sell-off was predominantly led by tech stocks, notably NVIDIA which fell over 6%, followed by Tesla which saw a decline of more than 4%. The catalyst behind this slump appears to be a combination of economic data indicating persistent inflationary pressures and uncertainties surrounding the Federal Reserve's monetary policies.

The day’s reports revealed that job vacancies in the U.Sfor November reached their highest level in six months, signaling a robust labor marketThe Institute for Supply Management (ISM) also reported better-than-expected growth in the service sector for DecemberSuch indicators suggest that despite efforts to mitigate inflation, the persistence of these conditions raises questions among investors about the potential for future interest rate cuts by the Fed.

As markets closed, the Nasdaq composite index dropped by 375.3 points, a notable decline of 1.89%. The S&P 500 index fell by 66.35 points, representing a 1.11% drop, while the Dow Jones Industrial Average decreased by 178.2 points, or 0.42%. This collective downturn reflected broader concerns regarding economic stability and inflation.

Among the tech giants, Amazon saw a dip of over 2%. Tesla’s shares ended at $394.36 each, reflecting a drop of 4.06%, bringing the company's current market capitalization down to approximately $1.3 trillion

Advertisements

Investor confidence was likely shaken by news that U.Sregulators may launch an investigation into Tesla's newly announced driver-assistance features, following reports of accidents allegedly linked to these technologies.

The National Highway Traffic Safety Administration (NHTSA) is conducting a preliminary evaluation of about 2.6 million Tesla vehicles after receiving complaints tied to the car manufacturer’s “Advanced Smart Summon” feature, which allows drivers to remotely summon their vehicles from parking spaces via a smartphone appAn investigation was prompted by reports of accidents where vehicles failed to detect stationary obstacles, raising serious safety concerns.

In the wake of this unsettling news, NVIDIA’s share price experienced its largest single-day drop since September 3, 2024, plummeting to $140.14 per share—down 6.22%. In this drastic dip, the company's market value vanished by an astounding $227.5 billion, equivalent to roughly 166.68 billion yuan

Advertisements

This downturn occurred despite the optimistic messages surrounding NVIDIA’s commitment to forefront developments in the semiconductor and GPU sectors during the lead-up to the Consumer Electronics Show (CES) in Las Vegas, where CEO Jensen Huang unveiled a slew of groundbreaking products, reinforcing NVIDIA's status as a powerhouse in its field.

While NVIDIA’s announcements have been regarded as forward-looking, they failed to meet the short-term expectations of some investors, as outlined in a report by Stifel Financial CorpThe lack of immediate catalysts for stock price appreciation has led investors to recalibrate their expectations, especially after witnessing substantial gains exceeding 200% over the past year.

In concert with NVIDIA’s struggles, semiconductor stocks faced a widespread decline, with the Philadelphia Semiconductor Index falling by 1.84%. Among the notable movers, Taiwan Semiconductor Manufacturing Company (TSMC) dropped over 3%, and Broadcom experienced a similar downturn, while Micron Technology saw a slight increase of over 2%.

Turning to Chinese stocks listed in the U.S., there was a mixed performance among major players

Advertisements

The Nasdaq Golden Dragon China Index saw a slight decline of 0.20%. Notably, XPeng Motors surged nearly 10% after the company announced plans to begin mass production of its flying car by 2026. Conversely, Alibaba and NIO faced losses, with Alibaba down over 1% and NIO declining more than 4%.

The economic overview was further detailed by the U.SDepartment of Labor, which released a report indicating that job vacancies in November soared to 8.1 million, a six-month high, bolstered by gains in the service sectorThis figure exceeded economists’ expectations by surpassing the revised October tally of 7.83 million.

Meanwhile, the U.Strade deficit expanded in November to $78.2 billion from the previous month’s $73.62 billion, as imports grew by 3.4%, reaching $351.56 billion, while exports increased by 2.6%, totaling $273.37 billionAnalysts had estimated the deficit would range between $74.5 billion and $92 billion.

The American Supply Management Association reported that service sector growth in December accelerated beyond expectations, heightening worries about enduring inflation

- Promoting Safe and Orderly Development of Nuclear Energy

- Nvidia Loses $240B in Market Value Overnight

- U.S. JOLTS Job Openings Exceed Expectations

- Elevating the Full Chain of China's Automotive Industry

- Anthropic Seeks $2B at $60B Valuation

Consequently, the yield on ten-year Treasury notes climbed nearly six basis points to reach 4.675% following the release of the data.

Looking ahead, private employment figures from ADP are anticipated on Wednesday, complemented by the more critical non-farm payroll report due Friday, which is expected to indicate a slowdown in hiringMarket analysts express skepticism that forthcoming non-farm job data will shift the Federal Reserve's stance, as officials continue to favor a cautious approach to further rate cuts amid ongoing economic expansion and a gradual cooling of inflationary pressuresThe Fed's latest meeting minutes, also set for release this week, are expected to offer deeper insights into officials’ future rate forecasts.

In summary, the combination of volatile stock performance, complex market dynamics, and pivotal economic indicators creates an intricate landscape for investors as they navigate the uncertainties of 2024, particularly in regards to the Fed's monetary policy and its implications for economic growth and inflation behavior.

Leave A Reply